XAU/USD Trading Strategy for October 24, 2024: Caution Amid Potential Volatility

Introduction

The XAU/USD, holding Gold against the US Dollar, takes the markets cautious on October 24, 2024. Since gold is there for whatever reason, it could change its stride from 17.00 USD to 26.00 USD, caution must be taken in some key support and resistance levels. The technique would be based on a short at 2730.00 USD, which also acts as a profit target of 2709.00 USD, and further down to an extension of 2700.00 USD. We will then dive into the technical analysis, explain why the strategy makes sense, and look at key price levels and indicators, such as the RSI.

Intraday Analysis: XAU/USD Levels to Watch

Prices of XAU/USD are going to oscillate between 17.00 and 26.00 USD, and there are some significant levels that the traders must pay attention to in intraday trading.

Resistance Levels

2747.00. It is the first resistance level. The possibility for the prices to move up after crossing this level is high with further acceleration of the speed at which the price moves in a higher direction.

2738.00. This is a second resistive level. In case of non-efficiency of the prices to touch this level combined with the upward movement, then there is a good chance of its limits for future movements.

2730.00: This is a turn and an important resistance level. Significant action below here puts in a lot of weight behind a bearish view.

Support Levels:

2726.00: The last traded price before things get messy with the bearish scenario.

2709.00: The first support level, and one which is an important near-term target for any shorts. A close below here could open up a potential window of further declines.

2700.00: This is a massive target support for the bears, and action in this area is going to be very crucial.

2692.00: If XAU/USD falls below 2700.00, 2692.00 will most likely function as the following flooring for prices.

RSI (Relative Strength Index) Outlook: Mixed Signals Call for Caution

Mixed signals coming from the RSI are interpreted as uncertainty in the market momentum. When indecisive, the RSI often signals a lack of strong directional conviction, and traders need to tread cautiously. A decline in the RSI below the neutral level of 50 may be interpreted as an increase in bearish momentum and a strengthened case for the short positions.

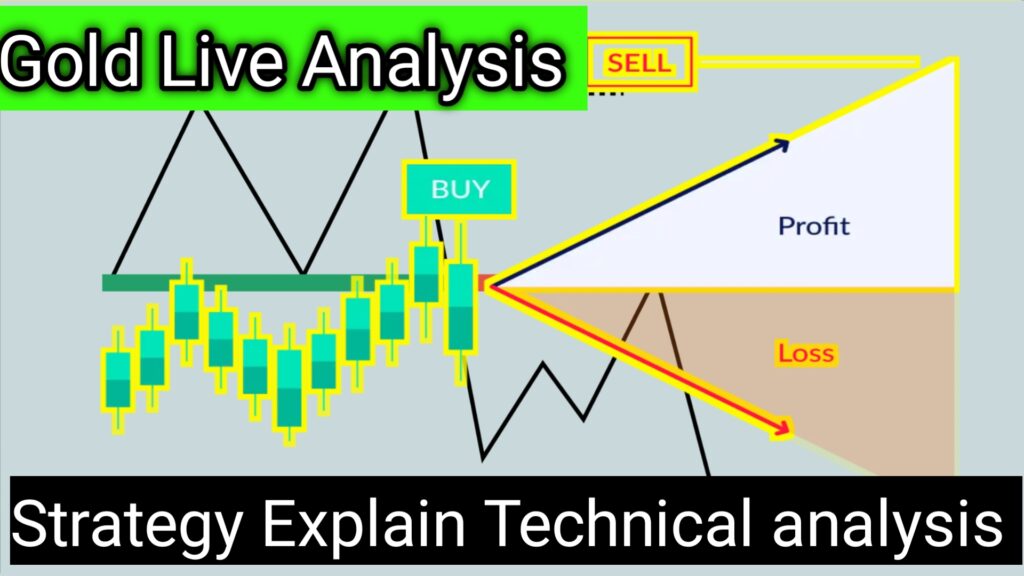

XAU/USD Trading Strategy: Short Below 2730.00

We would prefer to short at lower levels near 2730.00 in today’s session. Downward caps are likely if the price action fails to breach above major resistance levels. The following is the step-by-step approach:

Entry Point: Open the short position now if the price falls below 2730.00. This is very important because it was the pivot and resistance level.

First Target: The first target for this trade will be 2709.00, where the first layer of support is placed. When such a price arrives at that particular level, take partial profits or move your stop-loss to break even.

Extended Target: Next, if the market continues pushing downwards, then the next target would be at 2700.00. This is a place where stronger buying pressure may come, hence essential reevaluation of the market situation if this level is reached.

Stop-Loss Level: A stop-loss above level 2738.00 should be placed to reduce the risk. In case the price rises above this resistance, the bearish view would be negated and an exit from the trade would be needed.

Scenario Analysis: What if the Market Breaks Higher?

However, the short-term strategy is shifted down to a short below 2730.00. Other scenarios need to be considered. The gold market may break above 2738.00 or 2747.00 and momentum could push the price of it upstairs in a big way. That is to say, the prospects for the bullish scenario could be more positive under such conditions and some longs may keep an eye on the price when it arrives at 2755.00 or beyond.

Risk Management and Volatility Considerations

Since gold is volatile, especially when it is driven by exogenous events such as geopolitical risks or macroeconomic events, you should trade with a high level of control. That means that risk management will be very strict through stop-loss orders and position sizing in order to cap exposure.

Risk-to-Reward Ratio: The risk-to-reward ratio should be at least 1:2. That means that your potential small capital exposure is bigger compared to your gain.

Volatility Watch: Any major economic release or international news is in itself a reason to watch for changes in the direction of gold prices. Volatility increases during such activities, and prices can vary often.

Conclusion: A Cautious Approach to XAU/USD on October 24, 2024

Prices are expected to oscillate between the levels of resistance and support in the XAU/USD pair and a volatile session is in sight. Preferred in short positions below 2730.00, with targets at 2709.00 and 2700.00 in extension, the mixed RSI signals are yet another reason for caution, and traders should stay vigilant towards any price action at key levels. Of course, risk management is the best here, and according to market development, one should adjust his/her position.

As mentioned above, the strategy will be useful for today’s session to traders since they can be well-informed about opportunities that may occur over the short term while controlling risks.

Disclaimer

Information on this website, and any Posts, strategies, analyses, or opinions presented, are intended to be used for informational and educational purposes only. All such content is provided with the intent to offer general guidance within the overall scope of forex and trading and should not be considered financial advice, trading advice, or an offer to buy or sell any financial instruments.

High risk and not suitable for all types of investors, forex trading, and investments in the new cryptocurrencies. Trading leveraged products such as forex can cause losses no less important than gains. In any kind of trading, proper consideration of investment objectives, risk tolerance, and finance must be taken by the individual before trading activity. Highly recommended is to take advice from a licensed financial advisor or research on your own before entering into any trade.

We strive to provide current and accurate information, but we make no warranties about the accuracy, completeness, or timeliness of the information on this site. Past performance is no guide to future performance. Nothing on this site should be considered as an offer to sell securities or as a solicitation of an offer to buy securities.

Video, Posts, or learning material contents do not use any real personal information. All persons, accounts, and specific details used are fictional and for educational purposes only.

All risks that might be inherent in trading in the foreign exchange and financial markets are most likely something you should know of before participating. By accessing this site, you agree that we are not responsible for any losses that may be incurred due to your trading or investment activities as a result of the information herein.

Risk Warning: High-level risk involved: Any forex trading may result in total loss of your investment, so never invest money that you cannot afford to lose.