XAU/USD Trading Strategy for October 17, 2024: Aiming for $2695 – Potential for a Strong Upside Move

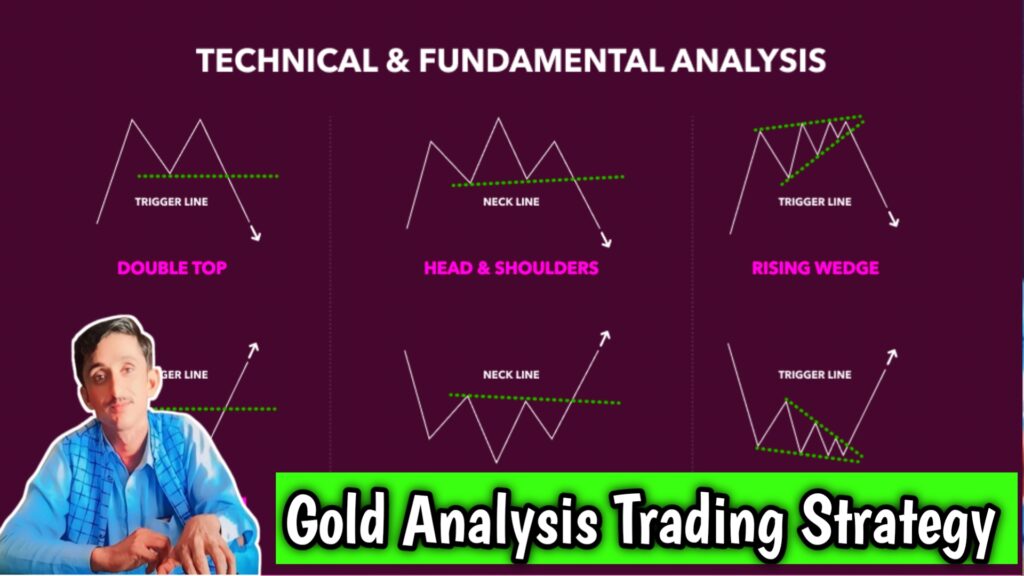

Introduction

Today, with this XAU/USD (Gold) trading strategy, we look forward to a potential upward rise in it to its key levels of resistance while an overall positive trend emanates from technical indicators and market dynamics as well. There is a strong probability of upward momentum for gold, and therefore, traders are suggested to be vigilant and monitor its price action to the critical support and resistance zones as well.

Market Overview for XAU/USD

On October 17, 2024, the XAU/USD is due to break out in a big way upwards. Gold can bounce up from $14.00 to $22.00, and that will truly show that the Bulls are winning this game. The main target for this trading session is $2695.00, with possible extensions to $2703.00 and maybe $2710.00. Market conditions support the rally more.

XAU/USD Trading Strategy: Go Long Above $2666.00

LONG POSITION ABOVE THE PIVOT POINT AT $2666.00. Thus far, that key support level has been held, so the markets are ready for a breakout long. The first extension is on $2695.00, then $2703.00, and $2710.00 where there are certainly stronger resistance points.

Levels to Watch Resistance Levels:

$2710.00 – This is the highest resistance for today, and if the price breaks above that, I will see a further advance.

$2703.00 – This is one critical resistance area. Today, sellers will be able to attempt to slow the rally here.

$2695.00 – This is an important resistance point that will be hit early this session. This will be our primary target for support.

Support Levels :

$2666.00– A pivotal level and an important level of support to keep an eye on. Since the market has yet to break below this level, the bullish bias remains in place.

$2656.00- A level of deeper support, likely to be breached if the market is bearish.

$2645.00 – The last line of support to hold on to, and once it’s broken, the market may focus the shift in the overall trend to the bearish side.

Technical Analysis

The Relative Strength Index (RSI) is the main indicator of today’s strategy. The RSI currently holds for further upward movement, which means that momentum is still in the favor of the bulls. When it trends above its neutral zone, it supports further advances in price.

The price action of Gold today is quite enough to make traders confident in taking long positions because the market is under strong stress near its supporting levels. The good uptrends and promising technical indicators further support this case for a bullish approach.

Strategy Explanation

Entry Point: The first opportunity to look for an entry to a buy is above $2666.00, the pivot point. That is where we expect sellers to give way and push the price up to our target.

Target Levels: One target to look out for is $2695.00. If the price breaks past that, it should move to $2703.00, and then to $2710.00 in extension. All of these levels act as potential profit zones for the bears who hold their position during the bullish run.

Stop Loss: If risk management is concerned, it should be placed a stop loss should be below the support level at $2666.00 so there are precautions taken in case of unexpected downward moves and possible losses if the market turns.

Conclusion

At current prices, it would appear that today’s strategy for XAU/USD trading is likely to be bullish, strong likelihood of going above $2695.00 and beyond. Hence, longs should be favored at prices higher than $2666.00, allowing the technical landscape to be used as a guide in determining the current chart condition, wherein now, the RSI suggests additional upside price movements.

Traders will reap the benefits of the bullish wave in the market, thereby making significant profits in trading for the day, with this strategy. Do not forget to watch key levels of support and resistance and change your positions as the market develops.

This is a human-written, SEO-friendly analysis that uses normal language and clearly puts forward an actionable strategy.